Ongoing research

The impact of the financial structure on business growth and profitability

As part of the activities of the AUB Observatory, with the contribution of FSI, this research was promoted with the aim of understanding whether the financial structure has an impact on the medium-long term performance (in terms of growth and profitability) of Italian companies

The research question

The financial structure of companies has long represented one of the central themes in the debate on the entrepreneurial fabric of our country and beyond. Put simply, companies can finance their activities using risk capital (equity) or by resorting to debt capital. What factors determine the choice of funding sources? And what are the consequences of the financial structure on the profitability of companies and their ability to grow?

In light of the main theories on the financial structure present in the literature, the present study has set itself the objective of verifying whether and to what extent a greater use of debt capital instead of equity can to some extent limit investment projects, reaching to act as a brake on the development projects of Italian companies. To this end, a double study was carried out, investigating the relationship between financing structure and growth and profitability: 1) on all the companies of the AUB Observatory; 2) on companies that have been the object of investment by a private equity fund.

You may download the research outputs by clicking on the links below:

-

FileResearch output - Executive Summary - AIDAF.pdf (234.93 KB)

-

FileResearch output - Presentation - AIDAF.pdf (468.65 KB)

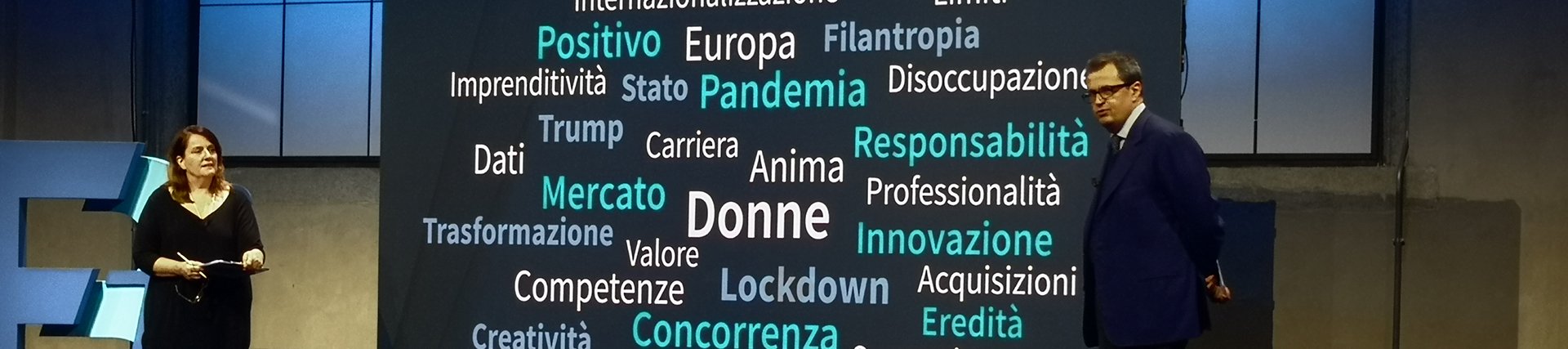

The reaction of listed companies to COVID-19

As part of the activities of the AUB Observatory, with the contribution of the Bocconi JEME association, research was conducted on the actions taken by listed family and non-family businesses to manage the impacts of the pandemic. The analysis was carried out on a sample of 310 companies listed on the Milan Stock Exchange (excluding banks and insurance companies), analyzing the second, third and fourth quarters of 2020 and through the first 3 "Management Reports" published in 2020 (as of 31.03.2020 , 30.06.2020 and 30.09.2020) and through the press releases published until December 2020.

The project is underway, and the full report will be published in 2022, but it is possible to anticipate a couple of findings:

- 29% of businesses - family and non-family - declared that they had already used smart-working as a form of work before the outbreak of the pandemic. During 2020, the companies that declared they use smart-working rose to 87%. Family businesses, which started from a smaller number (25%), have reached 85%. This confirms that the strength of Italian family businesses is their ability to react, even if in terms of work organization they show some delays. When forced to innovate, they quickly adapt to the new context. This is primarily due to very short chains of command that make it possible to decide and implement changes quickly;

- about 30% of family businesses made donations consisting of monetary donations. If this incidence is lower than that of non-family businesses (37%), looking at the amount of donations it can be seen that about 2/3 of monetary donations (equal to about 100 million euros) were made by family businesses. It is confirmed that family businesses try to establish "community" relationships where, beyond any ideological reading, the entrepreneur tries in every way to help his community, even in the face of objectively very difficult contexts.